Alright, so you’re not of retirement age. That’s a looong way off for you. Or, let’s say you’ve been responsible and you’ve been dutifully saving and investing for your retirement. Why does this matter?

It matters because you’ve all been paying for it–all your working lives unless you’re self employed, in the military or are a first responder. And, you’re going to continue paying for it even if there’s really nothing there in the end when you’re eligible to collect “benefits.”

Do you really think the government is going to stop collecting your money, that goes into their piggy bank where it collects interest and they can dip their fingers into it to pay for wars and such without paying it back? What planet are you living on?

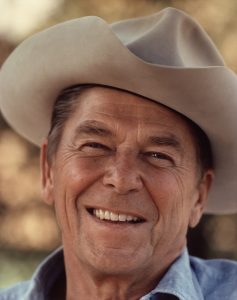

Remember that Social Security benefits were not taxable until 1983, when Ronald Reagan signed into law an amendment to the Social Security Act allowing benefits to be taxed.

Here’s what’s happening in the Republican party right now according to an October article on the MaddowBlog:

Larry Kudlow, the director of the Trump White House’s National Economic Council, recently said he wants to take aim at “entitlements” as early as “next year.” A few months earlier, House Speaker Paul Ryan (R-Wis.) said he wants to see policymakers bring the budget closer to balance by cutting “entitlements.” Rep. Steve Stivers (R-Ohio), who currently chairs the National Republican Congressional Committee, made the same argument in August.

And Congress, with presidential approval, has played sort of fast and loose with the funds in the trust, but they haven’t really seriously sought to reduce benefits–until now. Sure, there has been talk of reducing what the GOP refers to “entitlement programs” (Social Security, Medicare and Medicaid) but they’ve never had the numbers in Congress to push those reductions through. Now they do, and unless voters turn out in the November 6th election to elect more Democrats, a reduction in these programs seems almost certain.

And Congress, with presidential approval, has played sort of fast and loose with the funds in the trust, but they haven’t really seriously sought to reduce benefits–until now. Sure, there has been talk of reducing what the GOP refers to “entitlement programs” (Social Security, Medicare and Medicaid) but they’ve never had the numbers in Congress to push those reductions through. Now they do, and unless voters turn out in the November 6th election to elect more Democrats, a reduction in these programs seems almost certain.

Economists agree that Republican tax cuts for the 1% will result in a more than $1 trillion deficit. The Republican plan to reduce the deficit is to do away with the remnants of the Affordable Care Act and to cut “entitlements.”

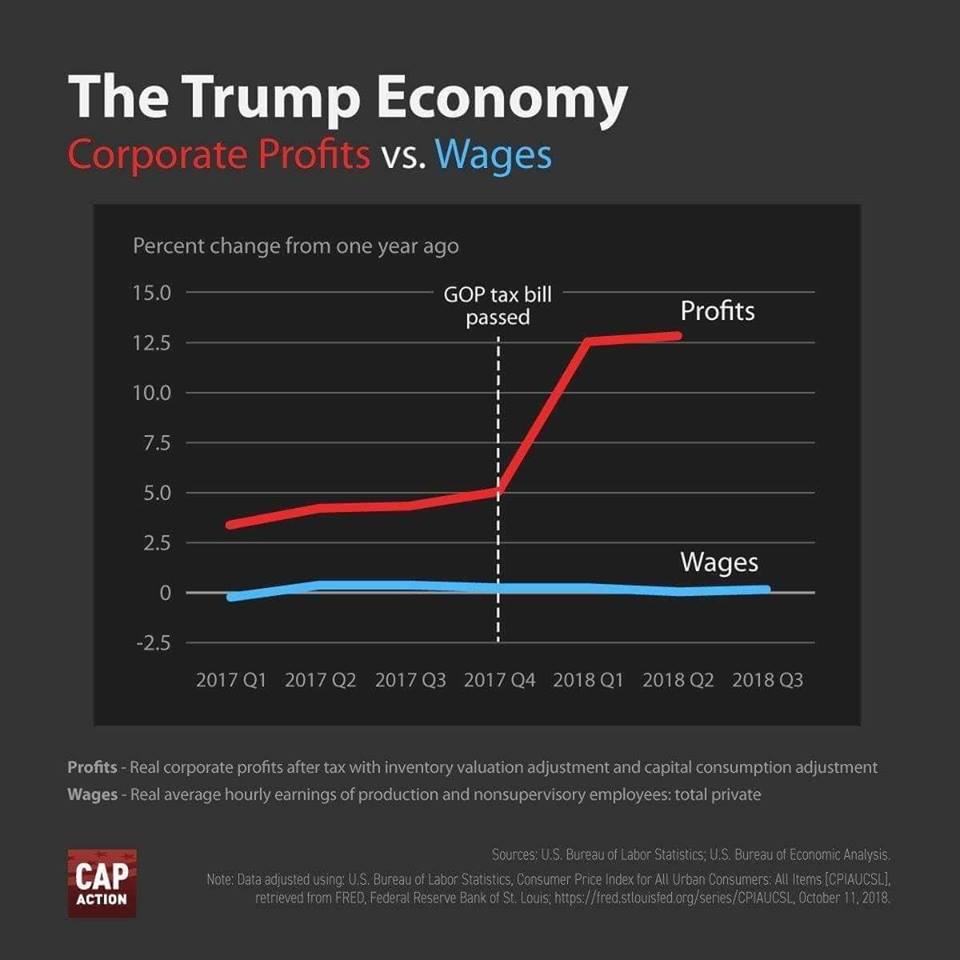

“The economy is so good!” people say. “Employment is way up!” people say. But how many jobs to you have to have to feed your family? Sure you can get a job more easily, but the facts show that wages have remained stagnant while inflation continues to rise, meaning that the dollar doesn’t go as far as it used to.

And here’s another fallacy about “entitlements.” Let’s say you have a decent job that includes retirement and heath care benefits. Let’s say you have even worked long enough at that job for your retirement and health care to vest. You’re sitting pretty, right? Maybe not so much if Congress cuts your Social Security and Medicare benefits.

If you’re wealthy, social security may not affect you very much, but it can be a couple thousand a month and that will buy you and your buddies a few lunches and rounds of golf at the country club. But once you turn 65, you are forced to go on Medicare. Again, if you’re wealthy, you just go out and buy the Cadillac plan and you’re set, but if you are like most of us–the middle class—you could find yourself coming up way short, having to purchase a costly health care plan to cover some of the expenses your employer used to pay for like the 20% of coverage and prescription drugs, vision and dental that Medicare doesn’t cover.

And if you are part of the poor or working poor and must rely on Medicaid, you could find yourself sitting in the county hospital emergency room to get treatment for your toothache.

Think about that when you go to the polls next Tuesday. You ARE going to vote next week, right?

In case you were wondering . . .